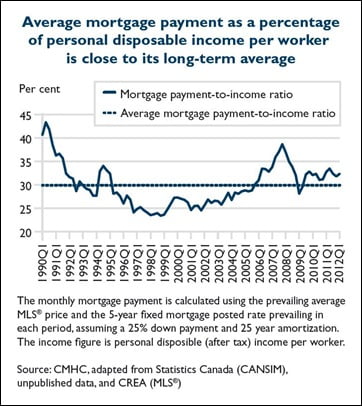

30+ percentage mortgage to income

With a Low Down Payment Option You Could Buy Your Own Home. Ad Get the Right Housing Loan for Your Needs.

Affordability Of New Homes In U S Resumes Decline In 2022 Seeking Alpha

Web The 3545 Rule.

. Begin Your Loan Search Right Here. Use our required income calculator above to personalize your unique financial situation. Web It typically ranges from 058 to 186 of your total mortgage amount and you will need to factor this in if your down payment is less than 20.

The percentage of purchase mortgages going to both moderate- and low-income borrowers drops by 75. To use the first part this rule youll need to determine your gross monthly income before taxes and multiply it by 035. Web What percentage of income should go to a mortgage.

Ad See what your estimated monthly payment would be with the VA Loan. Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. With a Low Down Payment Option You Could Buy Your Own Home.

Why Rent When You Could Own. 2022s Top Mortgage Lenders. Web 22 hours agoDow 30.

Every borrowers situation is different but there are at least two schools of thought on how much of your gross income should be. The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the. Some financial experts recommend other percentage models like the 3545 model.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Im assuming about 30 does that sound right. Income cannot exceed CalHFA income limits.

Ad Tired of Renting. Web Divide your monthly payments by your gross monthly income and then determine your DTI percentage by multiplying the resulting figure by 100. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Debt-to-income ratio DTI is a percentage that compares your total debts with your income. Compare Now Save.

The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more than 45 of their post-tax income. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Monthly debt payments monthly gross income X.

Were looking at buying and just curious what of your combined monthly income after tax assuming youre a joint-income household you use to furnish your mortgage. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. The 28 rule isnt universal.

You can plug these numbers plus your estimated down payment. For instance lets say. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

The average rate for 2021 was 296 the lowest annual average in 30 years. Web The 3545 Model. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool.

Were not including any expenses in estimating the income you need for a 500000 home. Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Why Rent When You Could Own. With that your other monthly debt should fit in. Get All The Info You Need To Choose a Mortgage Loan.

Web 8 Likes 0 Comments - Positive Real Estate positiverealestate on Instagram. The Combined Loan-to-Value CLTV must be between 7000 and 10500. Its important to keep track of all your expenses as a property owner as many of them.

The 36 should include your monthly mortgage payment. The DTI ratio is a borrowers monthly debt obligations. Ad See what your estimated monthly payment would be with the VA Loan.

Compare Offers Side by Side with LendingTree. Web Loan-to-Value LTV to follow the applicable mortgage insurerguarantor investor guide-lines CalHFAs Master Servicer Lakeview Loan Servicing and the applicable CalHFA first mortgage underwriting guidelines. For example if you make 10000 every month multiply 10000 by 028 to get.

With a Low Down Payment Option You Could Buy Your Own Home. Web The global Reverse Mortgage Providers market size is projected to reach USD 21606 million by 2026 from USD 15467 million in 2020 at a CAGR of 57 during 2021-2026. Ad 30 Year Mortgage Rates Compared.

Homeowner Association fees may be. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. With a Low Down Payment Option You Could Buy Your Own Home.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. To determine how much you can afford using this rule multiply your monthly gross income by 28. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Web A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Choose The Loan That Suits You. Ad Tired of Renting.

Explore Quotes from Top Lenders All in One Place. Your DTI is one way lenders measure your ability to manage monthly payments and repay the money you plan to borrow. Web 2 hours agoAffIt Today 1725.

Select Apply In Minutes. Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage payment.

Percentage Of Income For Mortgage Payments Quicken Loans

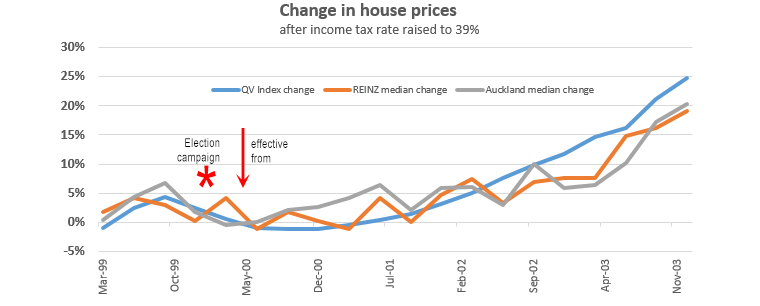

History Repeating Interest Co Nz

What Percentage Of Your Income To Spend On A Mortgage

Percentage Of Income For Mortgage Rocket Mortgage

Facts From The 2012 Canadian Housing Observer Mortgage Rates Mortgage Broker News In Canada

Buy A House Bob Shahidadpury Mortgage Loan Originator

How Much Of My Income Should Go Towards A Mortgage Payment

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Ry0crtvbpvbu4m

Georgia Has The 19th Highest Mortgage Delinquency Rate In The U S Metro Atlanta Ceo

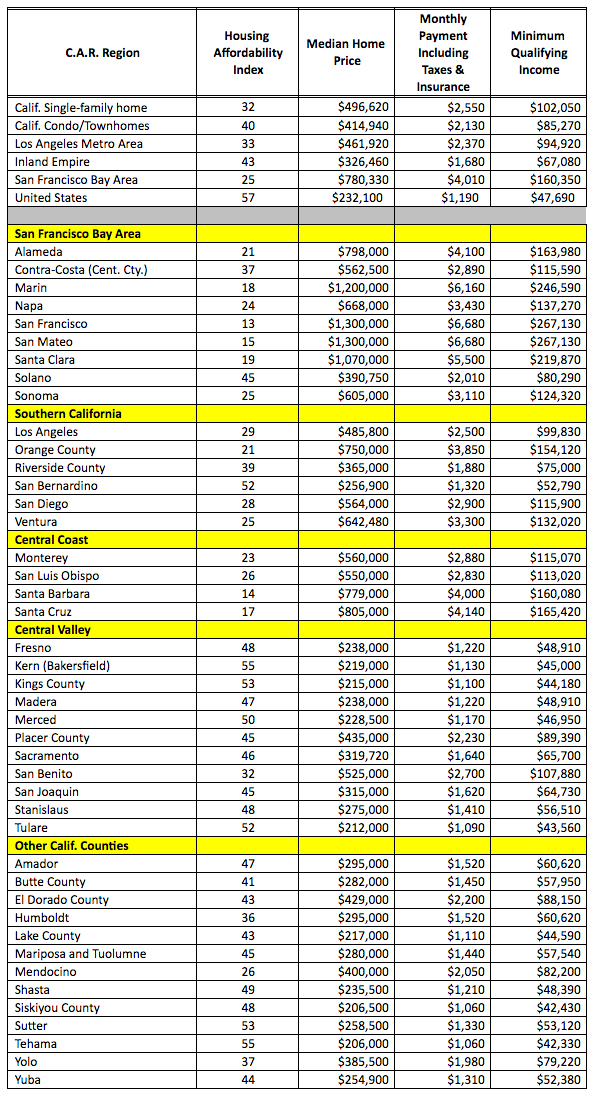

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

2i6d4mhrvsl6zm

Income Affluence Poverty The Cost Of Housing Housing Affordability In The San Francisco Bay Area Home Team Paragon Real Estate

How Debt And Income Affects Mortgage Affordability Homewise

Understanding Real Estate Data Investment Property Analytics Suburbsfinder

Independent Bank Group Inc Reports Third Quarter Financial Results And Declares Quarterly Dividend

U S Cities With The Highest Rates Of Mortgage Delinquency