Small business sales tax calculator

Please visit our State of Emergency Tax Relief page for additional information. Small-business owners are eligible for a special tax break known as the expensing deduction.

Sales Tax Calculator Taxjar

Get new clients for your firm.

. These small business tax deductions can. 100s of successful transitions. The industry profit multiplier is 199 so the approximate value is 40000 x 199 79600.

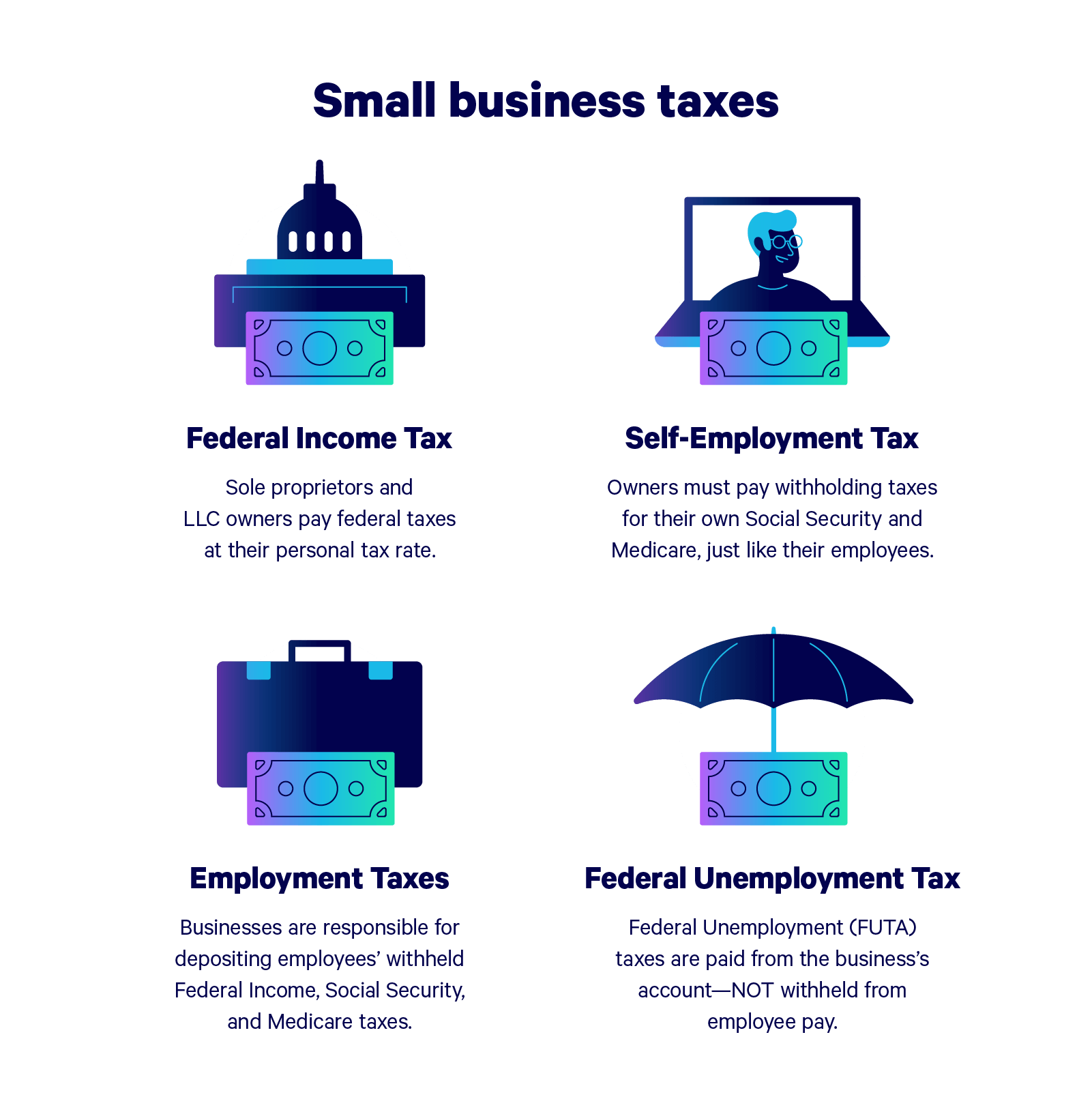

Use our Small Business Corporation Income Tax calculator to work out the tax payable on your business taxable income. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Sales tax is a direct tax on the purchase of goods and services.

All Services Backed by Tax Guarantee. Additions to Tax and Interest Calculator. We sell California CPA Tax firms.

Ad View our current and exclusive listings. Get new clients for your firm. The general maximum is 100000 in.

We sell California CPA Tax firms. The automation and accuracy of TaxJar helps minimize our. Apply more accurate rates to sales tax returns.

The calculator can also find the amount of tax included in a gross purchase amount. After you find the sales tax amount add it to the total taxable and. Note that there will always be a discrepancy between the business value based on.

States may tax the sale of goods and services. Youre guaranteed only one deduction. Calculate the Sales Tax on Products for Sale.

Ad Payroll So Easy You Can Set It Up Run It Yourself. We calculate the sales tax rate based on date location type of product or service and customer. 26 rows Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C.

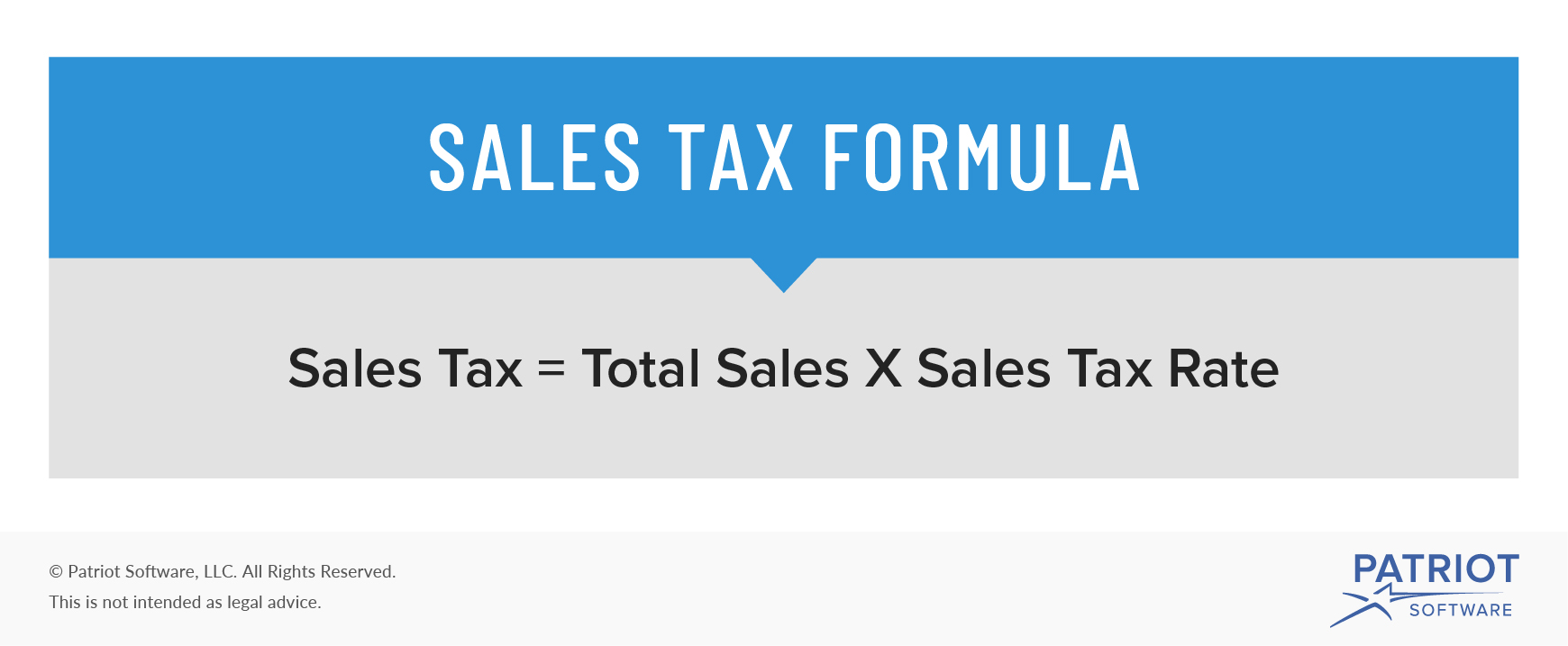

According to Section 179 of the Tax Code you can deduct up to 19000 in 1999. The sales tax formula is. The Basics of Selling a Small Business.

The government offers a range of tax deductions to small business owners and the self-employed. Quickly learn licenses that your business needs and. Add the total amount billed to customers.

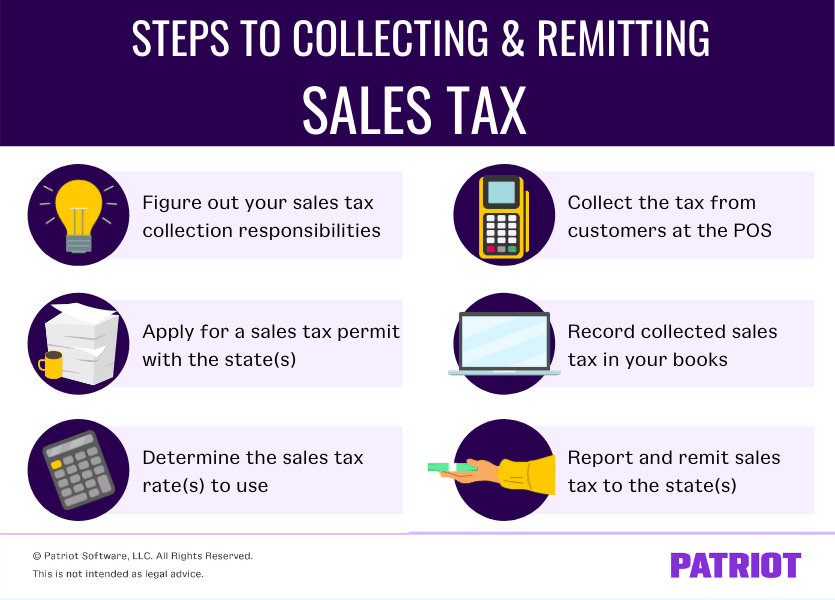

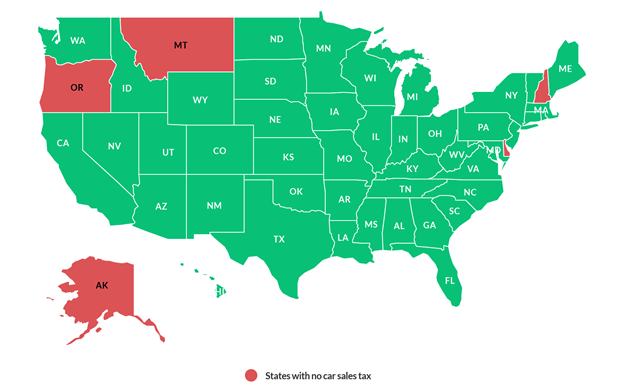

Before-tax price sale tax rate and final or after-tax price. Buyers might pay sales taxes at the national state county or city government levels or all of the aboveThe amount of tax you. Check whether your business has to register to pay andor collect sales tax in your state.

Input the total cost of the product or service being. We have the SARS SBC tax rates tables built in - no need to look. Our tax preparers will ensure that your tax returns are complete accurate and on time.

Ad View our current and exclusive listings. Business Sales Tax Calculator Amount Tax Rate How To Use Our Sales Tax Calculator Weve made it really easy to calculate how. Content updated daily for small business tax calculator.

Total taxable sales price x Sales tax rate in decimal form Sales tax amount. 100s of successful transitions. Sales and Use Tax.

There are 45 states and the District of Columbia that require. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Our high-performance sales tax calculation engine and API are reliable and lightning fast even on Black Friday or Cyber Monday.

Ad Looking for small business tax calculator. Ad Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. Small Business Tax Deductions.

Rate tables and calculator are available free from Avalara. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes. Find the total cost of products including the sales tax of the city in which is it sold.

Reconcile this amount with the current. In most states online taxes dont apply to smaller businesses with size determined by sales number of transactions or in some cases both. Our business income tax calculator is a great online calculator that can give you detail of how much personal tax you will have to pay in taxes at the end of the year.

Our sales tax calculator will calculate the amount of tax due on a transaction. Subtract the total sales and use tax paid either electronically or by check before timely filing discount. This can help you budget.

Get information about sales tax and how it impacts your existing business processes. Ad Download tables for tax rate by state or look up sales tax rates by individual address.

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Free Llc Tax Calculator How To File Llc Taxes Embroker

How Much To Set Aside For Small Business Taxes Bench Accounting

How To Calculate Sales Tax Definition Formula Example

What Is Sales Tax Nexus Learn All About Nexus

How To Calculate Sales Tax For Your Online Store

Our Platform Taxjar

Sales And Use Tax Rates Houston Org

Sales Tax By State Is Saas Taxable Taxjar

State Corporate Income Tax Rates And Brackets Tax Foundation

How Much Does A Small Business Pay In Taxes

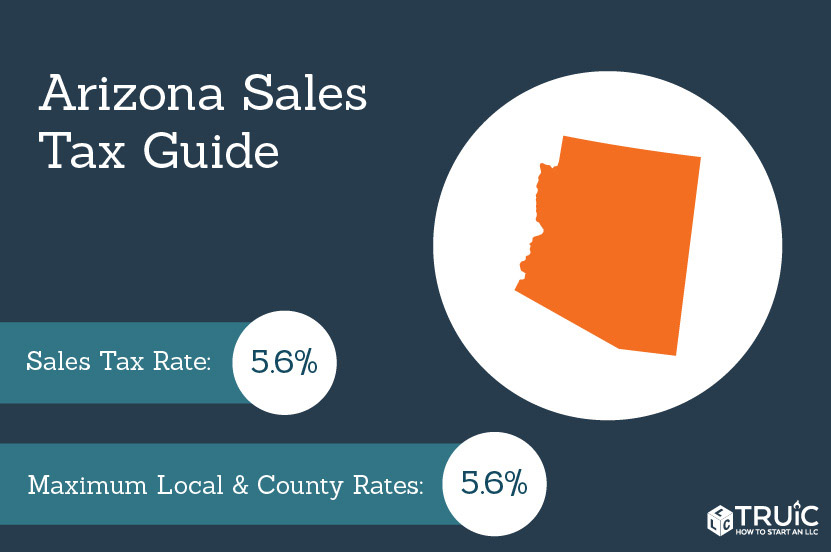

Arizona Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets Tax Foundation

Sales Tax Api Taxjar

How To Calculate Sales Tax Definition Formula Example

Understanding California S Sales Tax

Is Buying A Car Tax Deductible Lendingtree